Business

Business Intelligence: Why Every Organization Must Strengthen It?

Today, technological disruptions have changed the business dynamics. In addition to automation of workflows, businesses experience an influx of data – all thanks to digitization. From customers’ purchase history to spending patterns, companies have access to every piece of information. However, all the data collected from the digital forum is in its raw form; meaning, you have to interpret and analyze it. Thus, the question is how to make sense of this data?

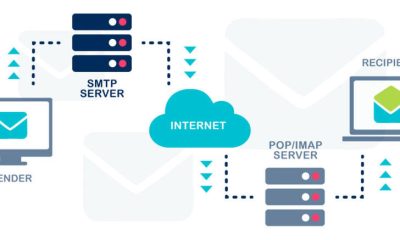

One of the best solutions could be integrating a business intelligence (BI) tool with the company’s IT infrastructure. BI leveraged software converts raw data into actionable insights that can drive business decisions. In simple words, business intelligence tools collect, store, and analyze data from different channels and mediums. Likewise, it examines and compares the company’s performance with the previous years, reflecting where the business stands.

Besides interpretation, BI offers data visualization, helping managers visualize the information as graphs, maps, and images. It makes it much easier for human minds to digest data and spot trends to make better decisions. If you are skeptical about BI, have a look below. Here are six reasons why every organization must strengthen its business intelligence.

1. Converts Raw Data into Usable Form

A significant challenge that businesses encounter is that they have too much information. Above that, the data is often incomprehensible in its raw form and requires an incredible amount of time for interpretation. Fortunately, this won’t be a problem with business intelligence tools. It presents information in a usable form, eliminating all unnecessary data. Similarly, it has strong data modeling capabilities that turn disparate databases into a single source of information.

In turn, managers can use BI and generate actionable insights from data. However, using these BI tools isn’t everyone’s cup of tea. You have to hire an analytics expert with MSA skills to navigate the BI software seamlessly. Look for candidates having a Master of Science in Analytics as they possess exceptional analytical skills and expertise. These Business Intelligence Course also teach them how to leverage the latest analytics software and techniques to analyze data.

2. Fosters Collaboration

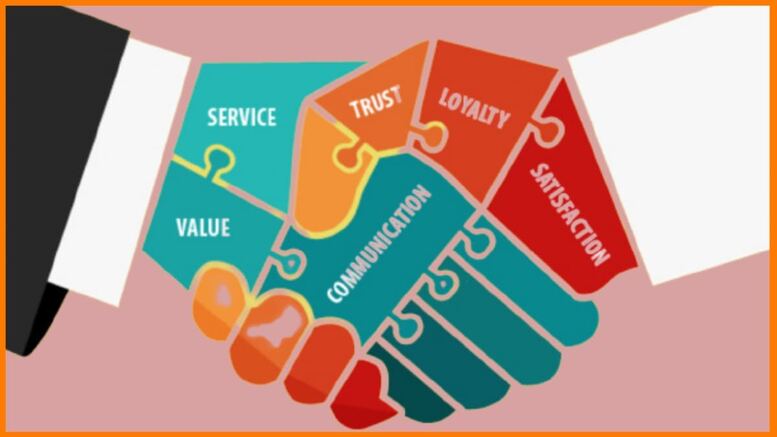

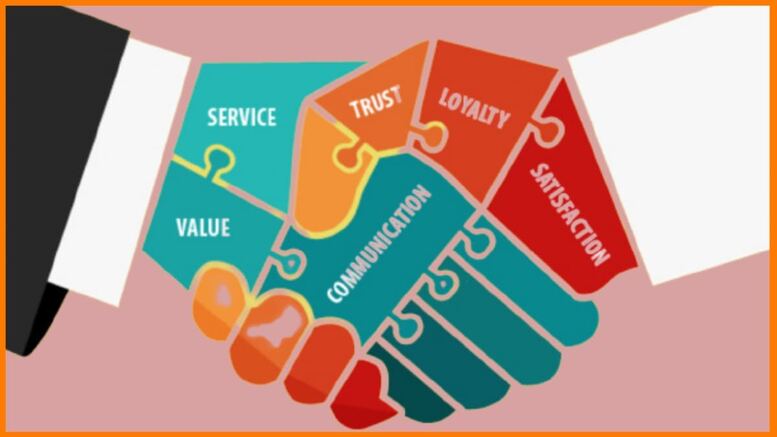

Truthfully, silos remain a massive problem in the corporate world. Businesses have been divided into departments where teams are insular, focusing on individual goals. It might look like a competitive work environment, but failing to engage with other business divisions can disrupt workflow. Well, to break the silos and foster collaboration, BI tools can come in handy. In addition to getting more teams to collaborate, BI can help in improving customer experience.

For sales, BI tools can visualize customer journeys. Similarly, they can create insightful forecasts and reports to determine what people want. The BI tools can also monitor customer service in real-time, identify areas of friction, and recognize risks ahead of time. Having a handful of information beforehand will allow organizations to collaborate within departments and overcome discrepancies.

3. Unfolds Customer Insights

Advanced business intelligence tools can help businesses understand their customers better. They can analyze customers’ buying patterns, spending habits and create user profiles. As a result, the intelligence software develops better product experiences for the customers. For instance, if a user has searched for a hair straightener, the website will create a ‘recommended for you’ section with straightening products.

Moreover, businesses can leverage the power of intelligent software to understand customer segmentation. Depending on the type of products a person buys, BI will classify that customer into different segments. As a result, the segmentation will provide a superior customer experience, integrating the element of personalization. These innovative practices create a win-win situation for customers and businesses as both parties benefit from them.

4. Streamlines Marketing Practices

Is your digital marketing campaign running in full swing? Although digitization has made marketing straightforward, there’s still a long way to go. Business intelligence can help organizations create marketing campaigns that generate a higher return on investment (ROI). It provides data regarding the current and previous campaigns, allowing managers to compare results. For instance, if the data shows the number of clicks on Google Ads is declining, you can reallocate the budget.

Similarly, BI tools unfold vital metrics such as customer acquisition cost (CAC) to determine if retaining a customer is cheaper. It also reveals the marketing campaigns’ click-through rates (CTR) and cost per lead (CPL). These stats will give insights into the performance of the marketing activities, showing if the promotions are generating desirable results or not. Besides this, you can utilize these insights to initiate and launch new marketing campaigns.

5. Improves Business Efficiency

Having a business intelligence system in place can significantly improve overall organizational efficiency. First, you have to make data accessible across various teams in the organization. It will reduce waiting time on the report requests, improving the workflows. At the same time, data accessibility can improve the productivity of all teams. After all, they won’t have to reach out to the managers to acquire bits and pieces of information.

Furthermore, BI can increase efficiency in call centers by reducing the long waiting times. It will display dashboards and report on efficiency in real-time. Thus, the managers will know when staff needs more attention, while workers can measure goals against preset targets. Remember, data accessibility across the organizations will allow everyone to stay informed and make knowledgeable decisions.

6. Facilitates Decision-Making

In a fast-paced business environment, entrepreneurs have to make decisions quickly but with utmost accuracy. Luckily, the BI tools and practices facilitate decision-making that keeps pace with the speed at which data compiles. In short, the tools automatically analyze data and present information in one easy-to-digest dashboard. Hence, managers can act on insights sooner and make more apt decisions for the business.

Moreover, you can spot trends and inefficiencies in the workflows before time. Likewise, product managers can make decisions regarding new launches after analyzing the overall demand. With rising data volumes, it has become essential to process and translate them into sound business decisions. Alongside understanding customer behavior, informed decision-making will help you outperform competitors.

Final Thoughts

As companies strive to be more data-driven, business intelligence will continue to evolve further in the coming years. Therefore, companies must strengthen their BI to keep up with emerging trends. The integrated BI software tools will help organizations interpret, share, and visualize data for better understanding. Likewise, it will open doors for collaboration, streamline marketing practices, and upscale business efficiency.

Business

Building trust in a rapidly evolving payments ecosystem

Digital payments have moved from convenience to critical infrastructure. For corporates, the priorities are clear: improve acceptance rates, keep fraud under control, satisfy rapidly changing regulation, and integrate new payment methods without disrupting core finance operations. With the growth of non-cash transactions and the rapid expansion of real-time payment networks, businesses are re-evaluating governance, controls, and reporting to ensure that speed does not compromise trust.

The payments landscape is scaling fast

Corporate treasurers face a wider mix of payment instruments than ever before, from cards and account-to-account transfers to instant rails and cross-border options. Non-cash transactions continue to climb globally, and the spread of instant payment schemes is reshaping expectations around settlement, liquidity, and exception handling. As volumes rise, so too does the complexity of reconciliation, chargeback management, and cost oversight—especially for businesses operating across multiple markets and acquirers.

Instant payments move from pilot to business-critical

Real-time payments have graduated from niche use cases to mainstream adoption in many regions. For corporates, instant rails can accelerate order-to-cash cycles, reduce dependence on card schemes for certain flows, and open new customer experiences such as just-in-time payouts or on-delivery collections. But operational readiness matters: liquidity buffers, 24/7 settlement processes, and robust alerting are essential to avoid bottlenecks when volumes spike outside traditional banking hours.

Checkout performance as a strategic lever

Small improvements in authorisation and conversion compound into significant revenue gains at scale. Optimising routing across gateways and acquirers, supporting preferred local methods, and using data-driven retry logic can materially raise acceptance rates. Equally important is cost transparency: finance teams increasingly model scheme fees, cross-border premiums, and fraud-management costs to select the right mix of rails per market and product.

Fraud, risk, and the trust equation

Remote purchase fraud remains a persistent threat in card-not-present channels. Strong customer authentication has reduced some attack vectors, but criminals continually adapt with social-engineering and mule-account tactics. Corporates need layered controls that combine risk-based authentication, device intelligence, velocity rules, and post-authorisation monitoring. Beyond the technology, incident playbooks and cross-functional drills ensure finance, customer support, legal, and IT respond in a coordinated way when cases surge.

Regulation is accelerating rather than slowing change

Payments regulation in the EU and UK continues to evolve with a focus on consumer protection, market integrity, and competition. For corporates, that means keeping product, legal, and treasury teams aligned on new obligations across authentication, data access, and liability. Preparing early for legislative updates cuts the risk of rushed changes that increase operational error or customer drop-off. It also creates opportunities to streamline disclosures and standardise consent across channels.

Data governance and reporting

As payment flows multiply, so do reporting requirements—from scheme rules and tax to statutory and regulatory disclosures. A single source of truth for payment data enables faster refunds and chargeback handling, supports audit readiness, and reduces the time spent reconciling across PSP dashboards and bank statements. Many corporates are moving toward a canonical payments data model that normalises fields across methods and providers, simplifying analytics and compliance attestation.

Practical steps corporates can take now

- Rationalise providers and railswhere possible to reduce operational variability, while retaining redundancy for resilience.

- Adopt risk-based authenticationtuned to channel and basket risk, with clear step-up paths to avoid unnecessary abandonment.

- Measure end-to-end conversionfrom checkout start through settlement, not just gateway authorisation, to find hidden drop-off points.

- Stress-test instant-payments operationsfor weekends and peaks, including liquidity coverage and reconciliation SLAs.

- Consolidate payments datainto a governed model that supports audit trails, regulatory reporting, and faster dispute resolution.

Where specialist support helps

For many organisations, the challenge is not choosing a single payment method but orchestrating a reliable, compliant mix across markets. Independent digital payment compliance for corporates can help teams interpret regulatory change, benchmark operating models, validate control frameworks, and improve acceptance and reconciliation without adding unnecessary complexity.

Outlook

Digital payments will continue to expand in volume, speed, and variety. Corporates that treat payments as a strategic capability—supported by strong governance, precise data, and disciplined compliance—will convert more sales, resolve fewer disputes, and build lasting customer confidence. Those that move early will also be best placed to adopt new rails and methods as they mature, without compromising cost control or audit readiness.

Read More: jacqulyn elizabeth hanley

Business

Navigating the Essentials of Employment Contracts: What Every Employer Should Know

Establishing clarity and fairness from the very beginning of an employment relationship is one of the most effective ways to build trust and avoid future disputes. A well-drafted contract of employment outlines the respective rights and responsibilities of both employer and employee, ensuring that expectations are transparent and legally sound. Despite this, many businesses—particularly small and medium-sized enterprises (SMEs) without in-house HR support—continue to overlook the importance of issuing detailed, compliant employment contracts.

More Than a Legal Requirement

In the United Kingdom, providing employees with a written statement of terms is a statutory requirement under the Employment Rights Act 1996. However, a formal contract of employment does far more than simply satisfy legal obligations. A carefully constructed agreement can safeguard a company’s interests in several key areas—from protecting confidential information and intellectual property to defining working hours, salary entitlements, and procedures for grievances or dismissal.

An employment contract acts as a reference point throughout the employee’s time with the company. It helps prevent misunderstandings over issues such as sick pay, parental leave, and notice periods. For employers, it also ensures that expectations around performance, conduct, and workplace policies are clearly documented. When such matters are left vague or omitted entirely, disputes become more likely and are harder to resolve.

Recent research from the CIPD (Chartered Institute of Personnel and Development) highlights the risks of inadequate communication around employment terms. Many cases of employee dissatisfaction and high turnover can be traced back to unclear or poorly explained contractual terms. This underlines the importance not only of drafting strong contracts but also of ensuring employees fully understand them from the outset.

Clauses You Shouldn’t Overlook

An effective employment contract should always include core terms such as:

- Job title and duties

- Place of work (including provisions for hybrid or remote work)

- Salary and payment intervals

- Working hours, including overtime expectations

- Holiday entitlement and public holidays

- Sickness absence and sick pay

- Notice periods for termination

- Confidentiality and data protection

- Disciplinary and grievance procedures

Failing to include or accurately word these elements can leave your business vulnerable. For instance, without an enforceable confidentiality clause, a departing employee may legally disclose sensitive information to a competitor. Furthermore, poorly written clauses or reliance on outdated templates can lead to inconsistencies, particularly where contract terms conflict with evolving employment legislation.

It is also essential to tailor contracts to reflect different employment types—such as permanent, part-time, zero-hours, or fixed-term roles—each of which carries specific rights and obligations under UK law. Using generic contracts across all employee types may result in non-compliance and potential tribunal claims.

Sourcing Trusted Contract Templates

To simplify the process while ensuring legal accuracy, many employers turn to professional resources. Platforms like Simply Docs offer a wide range of legally reviewed contract of employment templates designed to align with current UK employment law. These resources help business owners stay compliant and confident, without the cost of hiring external legal advisers for every role.

Updating Contracts in Line with Legislation

Employment contracts should not be seen as static documents. Laws change regularly—whether related to statutory pay rates, family leave, health and safety, or emerging workplace norms like hybrid working. For this reason, employers should review contracts annually and revise them in response to significant legal updates or organisational changes.

Keeping contracts up to date not only ensures compliance but also demonstrates that a business is serious about professionalism and employee wellbeing. In a tight labour market, offering clear and current employment terms can enhance your reputation as a trustworthy and desirable employer.

Final Thoughts

Providing a clear, fair, and comprehensive employment contract is one of the most important steps an employer can take. It strengthens the working relationship, reduces the risk of costly legal disputes, and shows that a business values its people. With reliable templates and regular reviews, employers can easily navigate the complexities of employment law and lay a solid foundation for long-term success.

Business

Struggling with Debt? Here’s a Simple Guide to Finding Relief Without Adding

Finding Relief Without Adding More Stress

Debt can feel like a heavy weight on your shoulders. You’re not alone – millions of Americans struggle with financial obligations every day. As Benjamin Franklin wisely noted, “Many a man thinks he is buying pleasure, when he’s really selling himself to it.” Let’s explore how to find relief without adding more stress to your life.

Why Debt Is More Common Than You Think

The numbers tell a powerful story. The average American household carries approximately $273,904 in federal debt according to recent statistics. This isn’t just a personal problem – it’s a national reality.

Feeling ashamed about debt? Don’t. Financial challenges affect people from all walks of life.

Even the federal government struggles with debt management, reporting a deficit of $1.1 trillion at the end of April 2025, which is 13% higher than the same time last year.

What Is Debt Relief?

Debt relief involves strategies to reduce or restructure your financial obligations, making them more manageable. It’s different from taking out more loans or declaring bankruptcy.

Relief programs typically negotiate with creditors to lower interest rates, reduce balances, or create more favorable repayment terms.

5 Signs You Might Benefit from Debt Relief

- You’re Only Making Minimum Payments. When you can only afford minimum payments, you’re mostly paying interest rather than reducing principal. This creates a never-ending cycle.

- You’re Using Credit to Pay for Necessities. Relying on credit cards for groceries, utilities, or rent indicates financial strain that needs addressing.

- You’re Receiving Collection Calls. Frequent calls from creditors or collection agencies signal that your debt situation has become serious.

- Your Debt-to-Income Ratio Exceeds 40%. If more than 40% of your monthly income goes toward debt payments, you may benefit from professional help.

- You Feel Overwhelmed by Financial Stress. When debt causes anxiety, sleep problems, or relationship strain, it’s time to seek solutions.

The Debt Relief Process Explained

1. Free Consultation

Most reputable debt relief services start with a no-cost assessment of your financial situation. This helps determine if you’re a good candidate for their programs.

According to CBS News, qualifying for debt relief in 2025 typically requires meeting certain thresholds, including credit score requirements and debt-to-income ratios, with more flexible options available through third-party debt relief programs compared to direct consolidation loans.

2. Personalized Plan Development

After analyzing your debts, income, and expenses, specialists create a customized strategy tailored to your specific situation.

“It’s a great idea when you’re struggling with debt to get free debt advice from a charity or a debt non-for-profit,” notes Businessing Magazine. These organizations can help you work out your debts and create a manageable budget.

3. Creditor Negotiation

Professional debt relief services negotiate directly with your creditors, potentially reducing interest rates, waiving fees, or even lowering principal balances.

This negotiation process can save you significant money and stress compared to trying to negotiate on your own.

Choosing a Trustworthy Service

The Federal Trade Commission recently announced a permanent ban on a fraudulent debt relief operation, highlighting the importance of selecting legitimate services.

Search for companies with transparent fee structures, clear explanations of their process, and no upfront fees before services are delivered.

Check reviews, ratings with the Better Business Bureau, and ask about their success rates with clients in situations similar to yours.

Cero Deuda: Support for Hispanic Americans

For Spanish-speaking Americans, Cero Deuda offers specialized debt relief services that understand cultural nuances and language preferences.

Their three-step process includes financial analysis, creditor negotiation, and creating personalized payment plans that typically span 12-48 months.

What sets them apart is their cultural understanding and bilingual support, making the debt relief process more accessible and comfortable for Hispanic communities.

Taking the First Step

The journey to financial freedom starts with a single step: acknowledging your situation and seeking help. Get in touch debt experts contact number for a free consultation to understand your options.

Remember that finding relief from debt is a process, not an overnight solution. With patience and the right support, you can gradually reduce your financial burden and the stress that comes with it.

The path to financial wellness is available to everyone – you just need to take that first step.

Read More: one piece filler

-

Biography7 years ago

Biography7 years agoJacqulyn Elizabeth Hanley is the Mother of Liza Soberano?

-

Biography7 years ago

Biography7 years agoAmanda Levy Mckeehan Biography, Family, Net Worth, Age, Affairs, Facts

-

Home6 years ago

Home6 years agoEpson L3110 Driver Free Download Latest Updated Version

-

Games4 years ago

Games4 years agoBest Free To Play MMORPG To Try This 2021

-

Biography7 years ago

Biography7 years agoWho is Rose Dorothy Dauriac? Scarlett Johansson Daughter?

-

Biography7 years ago

Biography7 years agoJessica Ditzel Secret Information that Nobody Knows | Joe Rogan’s Wife

-

Home7 years ago

Home7 years agoLiza Soberano Biography, Age, Family and Boyfriends

-

Biography7 years ago

Biography7 years agoWhat is the relation of Nathaniel Larry Osorno with Liza Soberano?