Crypto

Tools and Techniques for Analyzing Crypto Market Sentiment

These days, cryptocurrency continues to gain mainstream popularity. In the meantime, investors are looking for ways to gain insights into the crypto market sentiment to make better investment decisions. With the volatility of the crypto market, it’s essential to have the right tools and techniques to analyse market sentiment accurately. In this article, you can explore the various tools and methods used to analyse the crypto market.

Understanding Crypto Market

The crypto market is investors’ and traders’ overall feelings or attitudes towards the cryptocurrency market. It can be affected by various factors such as news, events, regulatory changes, and market trends. Positive market sentiment usually leads to increased demand, resulting in higher prices, while negative sentiment leads to decreased orders and lower costs.

Social Media Analysis

Social media is valuable for analysing the crypto market. Investors often use Twitter, Reddit, and other social media platforms to share their opinions on the market. By analysing social media sentiment, traders can gain insights into market sentiment and make better-informed decisions.

News Monitoring

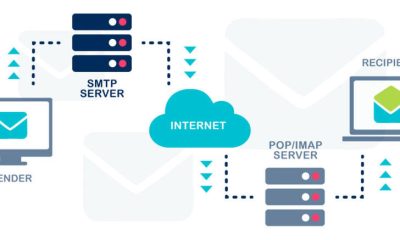

The crypto market is affected by news events. Monitoring news sources for events that could impact market sentiment is essential. News aggregators can be used to watch the news on crypto. There are also paid news monitoring services that provide real-time news alerts.

Sentiment Analysis Tools

Sentiment analysis tools are used to extract sentiment from text data. These tools use natural language processing (NLP) techniques to analyse text data and determine the sentiment of the text. Several sentiment analysis tools. These tools can analyse news articles, social media posts, and other text data.

Price Analysis

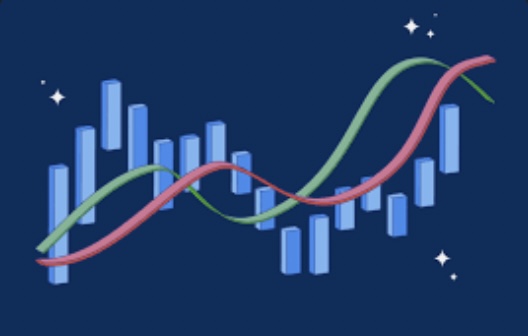

Price analysis is another technique used to analyse crypto sentiment, and technical analysis is a popular method. Technical analysis involves studying historical market data, such as price and volume, to identify patterns that can help predict future market trends. There are several technical analysis tools to analyse crypto market trends.

Market Sentiment Index

A market sentiment index is a tool that measures the market’s overall sentiment. It is often calculated by analysing market indicators such as price, volume, and social media sentiment. Many popular market sentiment index measures the fear and greed in the crypto market, calculated based on market volatility, volume, and social media sentiment.

Sentiment Score

A sentiment score to measure a particular cryptocurrency’s sentiment. Sentiment scores are often calculated using sentiment analysis tools. The sentiment score can determine the overall idea of a specific cryptocurrency and how it compares to other cryptocurrencies.

Community Engagement

It is a critical factor in determining crypto market sentiment. The level of community engagement can indicate the community’s overall feeling towards a particular cryptocurrency. By analysing community engagement, traders can gain insights into the community’s sentiment towards a specific cryptocurrency.

Expert Analysis

Expert analysis is another valuable tool for analysing the crypto market. Expert analysts often provide insights into market trends and events that could impact market sentiment.

It is essential in making investment decisions in the cryptocurrency market. By using the right tools and techniques, traders can better understand the overall market sentiment and make informed investment decisions. Social media analysis, news monitoring, sentiment analysis tools, price analysis, market sentiment index, sentiment score, community engagement, and expert analysis are some of the tools and techniques used for analysing sentiment.

In conclusion, analyzing crypto market sentiment is a critical component of successful trading in the cryptocurrency market. Using tools and techniques, traders can gain valuable insights into the market sentiment and make informed investment decisions. However, traders should also exercise caution and stay knowledgeable about the limitations of each tool and technique to mitigate the risks associated with investing in the highly volatile crypto market.

Crypto

From Courtside to Crypto: The Rise of Crypto Betting in 2025’s Sports Landscape

In 2025, the intersection of sports and digital currencies is rewriting the rules of fan engagement—most notably in the booming realm of crypto betting. As major leagues cement deals with decentralized platforms and fans seek faster, more secure wagering options, this global shift is changing how we follow the game.

Crypto Betting Busting Out on the Big Stage

During last month’s NBA playoffs, several prominent betting platforms quietly announced they’re now accepting not just fiat currency but Bitcoin (BTC), Ethereum (ETH), and stablecoins like Tether (USDT). These options aren’t just a convenience—they signal a growing demand among sports fans for instant deposits, faster payouts, and enhanced privacy.

Mary Henderson, a former casino croupier turned digital gambling expert, breaks it down:

“Most crypto sites accept players from all over with no third party delays. People want fast withdrawals in minutes, not business days,” she told CasinoMary.com, in a recent feature.

And she’s not alone. A mid May survey shows that 62% of bettors under 40 prefer using cryptocurrency on their favorite sportsbooks—a dramatic rise from just 18% in 2021.

Why Sports Bettors Are Making the Switch

- Speed & Privacy

Crypto transfers bypass traditional banks, enabling deposits and withdrawals in minutes. This convenience proves especially appealing during high-stakes championship weekends.

“Players appreciate not only speed, but the privacy—no need to share personal data with multiple financial institutions,” says Henderson . - Stablecoin Stability with USDT

Stablecoins like Tether (USDT) offer the benefits of crypto without Bitcoin’s notorious price volatility. Henderson notes that USDT “allows you to focus on the games. - Exclusive Market Access

In countries with restrictive online gambling laws, crypto platforms offer fans unobstructed access to betting pools and niche sports markets otherwise unavailable. - Enhanced Bonuses and Rewards

Crypto-first sportsbooks are attracting attention with bigger sign-up bonuses, loyalty tokens, and tokens tied to blockchain ecosystems—appealing especially to savvy bettors.

Legitimizing the Field

Critics still warn of risks: market volatility, lax regulations, and shady operators. In Canada, for example, while using offshore crypto sportsbooks is technically legal, domestic fiat-based platforms remain restricted.

To combat concerns, many customers now prioritize:

- Licensing Transparency: Reputable platforms display licensed jurisdiction info and validation certificates.

- Provably Fair Systems: Blockchain-based fairness algorithms allow bettors to confirm game integrity.

- Security Features: Two factor authentication and SSL encryption are expected, even mandatory.

- Health Checks via Reviews: Sites like CasinoMary and others provide user reviews, with warnings like “payment problems or delays” highlighted alongside praise for “fast withdrawal in 30 minutes”.

Sports Leagues Embrace Crypto Betting

A growing number of organizations—from football clubs to basketball leagues—are partnering with crypto platforms for sponsorships and fan tokens. One recent deal: a top-tier soccer team will issue its own digital tokens, tradeable for stadium seats, jerseys, and VIP matchday experiences.

Across North America, a new regulatory wave is forging licensing frameworks tailored to crypto gaming. States like Colorado and New Jersey are piloting limited-access crypto sportsbooks under stringent compliance standards.

What Fans Should Know

- Start with Stablecoins: If you’re new to crypto betting, using USDT is a smart way to dodge market fluctuations.

- Shop Secure Platforms: Only play on sites with transparent licensing and solid user reviews.

- Self-Manage: Wallet security is your responsibility. Keep passwords and recovery phrases offline.

- Set Limits: Crypto betting is no different from sports betting—play smart, set budgets, and stick to them.

Why This Matters for BobsCentral Readers

For sports fans accustomed to traditional sportsbooks and fantasy leagues, crypto betting isn’t just tech talk—it’s a growing ecosystem offering speed, privacy, and globalization in sports fandom. Whether you’re placing a props bet on next weekend’s basketball game, staking your claim on a championship futures market, or exploring loyalty tokens, the crypto angle is becoming unavoidable.

This evolution is more than hype—it’s deeply practical. If you’re curious how crypto betting really works—from depositing your first digital coin, to securing lightning fast withdrawals—our friends at CasinoMary have compiled an expert primer. Check out their guide to crypto casinos and betting to learn everything you need before taking your first digital position.

In Closing

As digital currencies permeate real-world industries, the world of sports betting stands at the forefront of innovation. Fans get faster payouts, more gaming options, and in some cases even more exclusive access—all without traditional banking friction.

For BobsCentral readers: the next time a big game is on, don’t just ask “who’s going to win”—ask “how are people wagering in this crypto powered age?” The game is changing, and smart fans are already placing their bets.

Crypto

The Crucial Role of FINPR in the Cryptocurrency Market: Amplifying Voices, Building Brands

In the rapidly evolving landscape of cryptocurrency and Web3 technologies, effective communication and strategic PR play a pivotal role in shaping narratives, building trust, and fostering adoption. Amidst this dynamic environment, FINPR emerges as a vital ally for projects seeking to navigate the complexities of the crypto market. With its extensive network, industry expertise, and proven track record, FINPR stands as a beacon of support for brands aiming to make their mark in the crypto sphere.

Amplifying Voices: Leveraging Global Media Connections

FINPR’s value proposition lies in its unparalleled network of contacts within the crypto ecosystem. With connections spanning leading crypto publishers, influencers, and media outlets, FINPR ensures that your story reaches not just any audience but the right audience. By leveraging these global media connections, FINPR secures organic coverage that amplifies your brand’s voice, fostering widespread visibility and engagement.

Understanding the Language, Embracing the Vision

Effective communication requires more than just conveying information. It demands a deep understanding of the industry’s language, culture, and vision. Herein lies another key strength of FINPR: its team’s immersion in the cryptocurrency and Web3 sector.

With a profound grasp of industry intricacies, FINPR’s professionals speak the language of crypto enthusiasts and stakeholders alike, ensuring that your message resonates authentically with your target audience. By aligning with your vision, FINPR crafts PR strategies that not only inform but also inspire, driving meaningful connections and fostering community engagement.

Proven Expertise, Notable Partnerships

With over seven years of experience in the industry, FINPR boasts a rich history of collaboration with prominent names in the crypto space. From Polkadex to Klaytn, AscendEX to Lbank, FINPR has partnered with a diverse array of clients, spanning various sectors within the cryptocurrency market.

This extensive portfolio underscores FINPR’s proven expertise in delivering results-driven PR solutions that propel brands to new heights. Moreover, the recognition received from major agencies such as Coincodex, Coinpedia, Bitcoinist, and International Business Times further solidifies FINPR’s standing as a trusted partner in the crypto PR landscape.

Tailored Strategies, Competitive Pricing

One size does not fit all in the world of PR, especially in the ever-evolving realm of cryptocurrency. Recognizing this, FINPR takes a personalized approach to crafting PR strategies, tailoring each plan to meet the unique needs and objectives of its clients.

Whether it’s building brand awareness, launching a new product, or executing a crowdfunding campaign, FINPR develops customized solutions that deliver tangible results. Moreover, with competitive pricing and secure financial terms, FINPR ensures that its services remain accessible to companies of all sizes, democratizing access to high-quality PR support within the crypto market.

Specialized Solutions for Crypto Fundraising

Beyond traditional PR and marketing services, FINPR specializes in providing crowdfunding PR and marketing solutions for a range of crypto fundraising mechanisms, including DeFi, IDO, IEO, STO, DAO, ICO, GameFi, and P2E. Leveraging its expertise in these areas, FINPR empowers projects to navigate the complexities of fundraising campaigns, maximize investor engagement, and drive token adoption. Whether it’s orchestrating a successful token sale or executing a strategic marketing blitz, FINPR equips brands with the tools and insights needed to thrive in the competitive world of crypto fundraising.

Conclusion

In the ever-expanding universe of cryptocurrency, effective PR and strategic communication are indispensable for brands aiming to carve out their niche and foster sustainable growth. As a trusted partner in the crypto PR landscape, FINPR plays a pivotal role in amplifying voices, building brands, and driving meaningful connections within the global crypto community. With its extensive network, industry expertise, and tailored solutions, FINPR stands ready to empower brands to thrive in the fast-paced world of cryptocurrency and Web3 technologies.

Crypto

Sell Bitcoin (BTC) to Visa and MasterCard TRY card

It is not possible to transfer Credit card in Turkish Lira to Bitcoin directly; you should use the help of an intermediary. The most convenient way to carry out the transaction is to cooperate with online exchangers. These resources offer favorable terms of cooperation, assistance from qualified technical support specialists and prompt processing of customer requests.

You should not search for a performer via the Internet, this can be fraught with loss of time and money. There are many scammers on the Global Network who are trying with all their might to lure the money of naive users and appropriate it for themselves. To avoid troubles and speed up the process of choosing the best offer, you should use the proven monitoring resource BestChange.

The portal bestchange.com/bitcoin-to-visa-mastercard-try.html publishes reliable exchange resources that offer sell Bitcoin (BTC) to Visa and MasterCard TRY card quickly and easily. All published exchangers have received many positive reviews from clients and have proven honest work. Working with such services will be easy and safe. You only need to choose a reliable service provider with optimal conditions for the transaction.

Features of choosing an exchange service for conducting a financial transaction

When choosing a suitable service provider for transferring Credit card to BitCoin cryptocurrency, it is important to pay attention to several key aspects:

- Exchange rate. Exchange rates may vary among different exchange platforms due to the fees they charge. Therefore, it is worth comparing different offers and choosing the most profitable one.

- Availability of cryptocurrency reserves. Before making an exchange, make sure that the exchanger you choose has enough Bitcoin to complete your trade in the required amount.

- Amount restrictions. Check if there are restrictions on the minimum or maximum exchange amount. This may influence your choice of platform.

- Additional commissions. Research any additional fees that may be applied to your trade, as they can significantly impact the profitability of the exchange.

- Technical support. Check for 24/7 technical support. If problems arise, it is important to be able to get help and answers to questions.

- Bonus program. If you plan on making frequent trades, find out if there is a frequent flyer bonus program that will allow you to earn extra bonuses on every trade.

To easily compare different offers and choose the best option, you can use the BestChange aggregator. On the resource bestchange.com you can search for rating of exchange websites in order to choose the most advantageous offer and conduct an exchange with confidence in its safety. Make informed choices when exchanging cryptocurrencies.

How to conduct a financial transaction

After choosing the best offer on the BestChange online exchanger, you should go to its official website to carry out the transaction. There you will see preset options for asset conversion, including source and target currency, which are usually configured automatically.

Next, fill out the application form with the following required information:

- The amount of Turkish Lira that you intend to exchange for the Bitcoin cryptocurrency.

- Details of your cryptocurrency wallet.

- Your name and contact details.

Before submitting an exchange application, be sure to check the correctness of the specified data to avoid possible errors and typos. After this, make payment for the application within the established deadlines, as failure to meet the deadlines may lead to cancellation of the application.

After successful payment, all you have to do is wait for your cryptocurrency wallet to be replenished, which usually takes from 30 to 60 minutes. Once the funds are credited to your balance, the exchange operation will be considered successfully completed.

Cooperation with verified exchangers on the instagram.com/bestchange/ monitoring portal guarantees you the safety, simplicity and profitability of exchange operations.

-

Biography7 years ago

Biography7 years agoJacqulyn Elizabeth Hanley is the Mother of Liza Soberano?

-

Biography7 years ago

Biography7 years agoAmanda Levy Mckeehan Biography, Family, Net Worth, Age, Affairs, Facts

-

Home6 years ago

Home6 years agoEpson L3110 Driver Free Download Latest Updated Version

-

Games5 years ago

Games5 years agoBest Free To Play MMORPG To Try This 2021

-

Biography7 years ago

Biography7 years agoWho is Rose Dorothy Dauriac? Scarlett Johansson Daughter?

-

Home7 years ago

Home7 years agoLiza Soberano Biography, Age, Family and Boyfriends

-

Biography7 years ago

Biography7 years agoJessica Ditzel Secret Information that Nobody Knows | Joe Rogan’s Wife

-

Biography7 years ago

Biography7 years agoWhat is the relation of Nathaniel Larry Osorno with Liza Soberano?