Business

5 Best Strategies for Banking User Experience

The banking industry is growing immensely due to technological advances. Today, digital banking is taking over the market, and the competition is stiff. Many financial institutions strive to develop great products that meet the needs of their customers.

However, it’s vital to keep in mind that customers stay loyal to banks that offer exceptional user experience. Users are usually satisfied if a bank app is user-friendly, appealing, and functional. But if your app is poorly designed with cluttered elements and broken links, you might compromise how users interact with your app. The chances of losing customers are high because of a few fixable design flaws. UX design is also important since it determines the success of banking apps and websites. Therefore, you must develop an exceptional bank app UX design that offers great experiences.

This article explores the best strategies you can adopt to enhance user experience in the banking sector.

#1 Gather Accurate Customer Data

The first approach you need to take is to gather customer information across all the touch points of your product. Understanding what customers feel about your bank app or website is imperative. So, you need to collect accurate information on all platforms to get customers’ experience; in other words, you should walk in the users’ shoes. Does your app offer a consistent user experience, or is it different on each channel? Keep in mind that your main objective is to offer a consistent and seamless experience that matches your brand’s reputation. Ensure you collect data from your customers about the bank; you might discover critical loopholes that interfere with user experience.

You can use one of the strategies we’ve laid out below.

Physical Branch

You need to find out what customers think about your bank branch and the physical services employees offer. Send out short, simple surveys immediately after a customer visits and leaves the branch. For instance, a text message is a convenient method with a quick response. However, make sure you use the right communication for each customer. Other people don’t want text messages and would prefer emails.

Website or App

Another approach is to incorporate client satisfaction surveys on the website. Ask their customers about specific actions they have experienced on the site. You can also email surveys to the customers to inquire them about the general outlook and perception of the website or application.

Customer Support Feedback

Gathering feedback from customer service is also essential. It will allow you to identify the friction areas and resolve the design flaws.

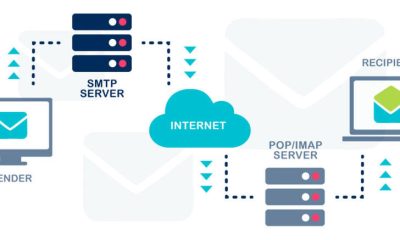

#2 Multiple Communication Avenues

With technological advances, many customers want to explore diverse communication options. If the only communication channel for customers is the telephone, you are missing out on digital platforms. Not all customers can call the physical branch to get assistance. Besides, calls can be frustrating if you have to wait in line to be addressed. So, you can introduce several support options to enhance the UX. For instance, a chatbot is more convenient and easy to use for urgent inquiries. Chatbots are machine-simulated robots that chat like humans. The bots can answer simple and frequently asked questions.

Live chats are another affordable support option with 24/7 agents available to respond to customers. However, some users might still prefer to communicate via email, SMS messaging, or contact forms.

It’s also vital not to underscore social media. With the upsurge of social media platforms, many banks now have social media accounts offering customer support. These include WhatsApp, Facebook, Twitter, etc.

Automation

Technology plays a critical role in improving customer experience. Many financial institutions are automating their services for optimal results. Making use of technology will boost customer satisfaction rates because of efficiency, as customers no longer queue at the bank branch to deposit money or initiate withdrawals.

Many banks have adopted digital banking through apps and websites. So, one can access mobile services regardless of time and location, which is quite convenient. Moreover, technology reduces a customer’s time to complete certain tasks like transferring money, check processing, or depositing.

Financial institutions also diversify to provide shopping vouchers and contests with rewards to enhance customer experience and satisfaction.

With the emergence of AI, predictive models have become increasingly valuable in the banking sector. You can analyze past customer information and interactions and predict advanced products and services to cater to customers’ growing needs.

Customer Retention

The banking industry is very competitive, and many financial actors launch new digital products daily to stay in business. It is common to find banks with stellar websites and top-notch mobile apps in the market. Established financial institutions offer online banking as an additional service, but there are modern banks that offer the digital platform as a core business.

For instance, you can easily locate financial firms offering investment opportunities online without visiting their physical office. Such companies get a loyal following of customers because of selling convenient products and services.

Thus, banks with better products and great services often have high client retention rates. If you focus on retaining your clients, you will go the extra mile to ensure exceptional experiences.

Identify Friction Points

It is important to know how customers interact with your bank app. Are there any alarming friction points? Is the user journey seamless or not? Does account opening have many steps to complete? Such questions help you identify your products’ critical UX issues and vulnerabilities.

Many users abandon an app or website after encountering friction. It could be because of a confusing and cluttered interface or an endless form to fill out. Whatever the case, you must find out why customers abort the product use before taking the expected actions.

Find out all the frustrating features and fix the design flaws. Remember, usability is paramount in providing a seamless user experience.

Conclusion

The banking industry needs quality UX designs to satisfy customers. A banking app with a good UX approach is vital for business growth and brand reputation.

So, you need to create a product with appealing and functional features. Ensure the customer service agents are responsive and friendly. In addition, identify pain points and fix all problems getting in your users’ way.

Business

Building trust in a rapidly evolving payments ecosystem

Digital payments have moved from convenience to critical infrastructure. For corporates, the priorities are clear: improve acceptance rates, keep fraud under control, satisfy rapidly changing regulation, and integrate new payment methods without disrupting core finance operations. With the growth of non-cash transactions and the rapid expansion of real-time payment networks, businesses are re-evaluating governance, controls, and reporting to ensure that speed does not compromise trust.

The payments landscape is scaling fast

Corporate treasurers face a wider mix of payment instruments than ever before, from cards and account-to-account transfers to instant rails and cross-border options. Non-cash transactions continue to climb globally, and the spread of instant payment schemes is reshaping expectations around settlement, liquidity, and exception handling. As volumes rise, so too does the complexity of reconciliation, chargeback management, and cost oversight—especially for businesses operating across multiple markets and acquirers.

Instant payments move from pilot to business-critical

Real-time payments have graduated from niche use cases to mainstream adoption in many regions. For corporates, instant rails can accelerate order-to-cash cycles, reduce dependence on card schemes for certain flows, and open new customer experiences such as just-in-time payouts or on-delivery collections. But operational readiness matters: liquidity buffers, 24/7 settlement processes, and robust alerting are essential to avoid bottlenecks when volumes spike outside traditional banking hours.

Checkout performance as a strategic lever

Small improvements in authorisation and conversion compound into significant revenue gains at scale. Optimising routing across gateways and acquirers, supporting preferred local methods, and using data-driven retry logic can materially raise acceptance rates. Equally important is cost transparency: finance teams increasingly model scheme fees, cross-border premiums, and fraud-management costs to select the right mix of rails per market and product.

Fraud, risk, and the trust equation

Remote purchase fraud remains a persistent threat in card-not-present channels. Strong customer authentication has reduced some attack vectors, but criminals continually adapt with social-engineering and mule-account tactics. Corporates need layered controls that combine risk-based authentication, device intelligence, velocity rules, and post-authorisation monitoring. Beyond the technology, incident playbooks and cross-functional drills ensure finance, customer support, legal, and IT respond in a coordinated way when cases surge.

Regulation is accelerating rather than slowing change

Payments regulation in the EU and UK continues to evolve with a focus on consumer protection, market integrity, and competition. For corporates, that means keeping product, legal, and treasury teams aligned on new obligations across authentication, data access, and liability. Preparing early for legislative updates cuts the risk of rushed changes that increase operational error or customer drop-off. It also creates opportunities to streamline disclosures and standardise consent across channels.

Data governance and reporting

As payment flows multiply, so do reporting requirements—from scheme rules and tax to statutory and regulatory disclosures. A single source of truth for payment data enables faster refunds and chargeback handling, supports audit readiness, and reduces the time spent reconciling across PSP dashboards and bank statements. Many corporates are moving toward a canonical payments data model that normalises fields across methods and providers, simplifying analytics and compliance attestation.

Practical steps corporates can take now

- Rationalise providers and railswhere possible to reduce operational variability, while retaining redundancy for resilience.

- Adopt risk-based authenticationtuned to channel and basket risk, with clear step-up paths to avoid unnecessary abandonment.

- Measure end-to-end conversionfrom checkout start through settlement, not just gateway authorisation, to find hidden drop-off points.

- Stress-test instant-payments operationsfor weekends and peaks, including liquidity coverage and reconciliation SLAs.

- Consolidate payments datainto a governed model that supports audit trails, regulatory reporting, and faster dispute resolution.

Where specialist support helps

For many organisations, the challenge is not choosing a single payment method but orchestrating a reliable, compliant mix across markets. Independent digital payment compliance for corporates can help teams interpret regulatory change, benchmark operating models, validate control frameworks, and improve acceptance and reconciliation without adding unnecessary complexity.

Outlook

Digital payments will continue to expand in volume, speed, and variety. Corporates that treat payments as a strategic capability—supported by strong governance, precise data, and disciplined compliance—will convert more sales, resolve fewer disputes, and build lasting customer confidence. Those that move early will also be best placed to adopt new rails and methods as they mature, without compromising cost control or audit readiness.

Read More: jacqulyn elizabeth hanley

Business

Navigating the Essentials of Employment Contracts: What Every Employer Should Know

Establishing clarity and fairness from the very beginning of an employment relationship is one of the most effective ways to build trust and avoid future disputes. A well-drafted contract of employment outlines the respective rights and responsibilities of both employer and employee, ensuring that expectations are transparent and legally sound. Despite this, many businesses—particularly small and medium-sized enterprises (SMEs) without in-house HR support—continue to overlook the importance of issuing detailed, compliant employment contracts.

More Than a Legal Requirement

In the United Kingdom, providing employees with a written statement of terms is a statutory requirement under the Employment Rights Act 1996. However, a formal contract of employment does far more than simply satisfy legal obligations. A carefully constructed agreement can safeguard a company’s interests in several key areas—from protecting confidential information and intellectual property to defining working hours, salary entitlements, and procedures for grievances or dismissal.

An employment contract acts as a reference point throughout the employee’s time with the company. It helps prevent misunderstandings over issues such as sick pay, parental leave, and notice periods. For employers, it also ensures that expectations around performance, conduct, and workplace policies are clearly documented. When such matters are left vague or omitted entirely, disputes become more likely and are harder to resolve.

Recent research from the CIPD (Chartered Institute of Personnel and Development) highlights the risks of inadequate communication around employment terms. Many cases of employee dissatisfaction and high turnover can be traced back to unclear or poorly explained contractual terms. This underlines the importance not only of drafting strong contracts but also of ensuring employees fully understand them from the outset.

Clauses You Shouldn’t Overlook

An effective employment contract should always include core terms such as:

- Job title and duties

- Place of work (including provisions for hybrid or remote work)

- Salary and payment intervals

- Working hours, including overtime expectations

- Holiday entitlement and public holidays

- Sickness absence and sick pay

- Notice periods for termination

- Confidentiality and data protection

- Disciplinary and grievance procedures

Failing to include or accurately word these elements can leave your business vulnerable. For instance, without an enforceable confidentiality clause, a departing employee may legally disclose sensitive information to a competitor. Furthermore, poorly written clauses or reliance on outdated templates can lead to inconsistencies, particularly where contract terms conflict with evolving employment legislation.

It is also essential to tailor contracts to reflect different employment types—such as permanent, part-time, zero-hours, or fixed-term roles—each of which carries specific rights and obligations under UK law. Using generic contracts across all employee types may result in non-compliance and potential tribunal claims.

Sourcing Trusted Contract Templates

To simplify the process while ensuring legal accuracy, many employers turn to professional resources. Platforms like Simply Docs offer a wide range of legally reviewed contract of employment templates designed to align with current UK employment law. These resources help business owners stay compliant and confident, without the cost of hiring external legal advisers for every role.

Updating Contracts in Line with Legislation

Employment contracts should not be seen as static documents. Laws change regularly—whether related to statutory pay rates, family leave, health and safety, or emerging workplace norms like hybrid working. For this reason, employers should review contracts annually and revise them in response to significant legal updates or organisational changes.

Keeping contracts up to date not only ensures compliance but also demonstrates that a business is serious about professionalism and employee wellbeing. In a tight labour market, offering clear and current employment terms can enhance your reputation as a trustworthy and desirable employer.

Final Thoughts

Providing a clear, fair, and comprehensive employment contract is one of the most important steps an employer can take. It strengthens the working relationship, reduces the risk of costly legal disputes, and shows that a business values its people. With reliable templates and regular reviews, employers can easily navigate the complexities of employment law and lay a solid foundation for long-term success.

Business

Struggling with Debt? Here’s a Simple Guide to Finding Relief Without Adding

Finding Relief Without Adding More Stress

Debt can feel like a heavy weight on your shoulders. You’re not alone – millions of Americans struggle with financial obligations every day. As Benjamin Franklin wisely noted, “Many a man thinks he is buying pleasure, when he’s really selling himself to it.” Let’s explore how to find relief without adding more stress to your life.

Why Debt Is More Common Than You Think

The numbers tell a powerful story. The average American household carries approximately $273,904 in federal debt according to recent statistics. This isn’t just a personal problem – it’s a national reality.

Feeling ashamed about debt? Don’t. Financial challenges affect people from all walks of life.

Even the federal government struggles with debt management, reporting a deficit of $1.1 trillion at the end of April 2025, which is 13% higher than the same time last year.

What Is Debt Relief?

Debt relief involves strategies to reduce or restructure your financial obligations, making them more manageable. It’s different from taking out more loans or declaring bankruptcy.

Relief programs typically negotiate with creditors to lower interest rates, reduce balances, or create more favorable repayment terms.

5 Signs You Might Benefit from Debt Relief

- You’re Only Making Minimum Payments. When you can only afford minimum payments, you’re mostly paying interest rather than reducing principal. This creates a never-ending cycle.

- You’re Using Credit to Pay for Necessities. Relying on credit cards for groceries, utilities, or rent indicates financial strain that needs addressing.

- You’re Receiving Collection Calls. Frequent calls from creditors or collection agencies signal that your debt situation has become serious.

- Your Debt-to-Income Ratio Exceeds 40%. If more than 40% of your monthly income goes toward debt payments, you may benefit from professional help.

- You Feel Overwhelmed by Financial Stress. When debt causes anxiety, sleep problems, or relationship strain, it’s time to seek solutions.

The Debt Relief Process Explained

1. Free Consultation

Most reputable debt relief services start with a no-cost assessment of your financial situation. This helps determine if you’re a good candidate for their programs.

According to CBS News, qualifying for debt relief in 2025 typically requires meeting certain thresholds, including credit score requirements and debt-to-income ratios, with more flexible options available through third-party debt relief programs compared to direct consolidation loans.

2. Personalized Plan Development

After analyzing your debts, income, and expenses, specialists create a customized strategy tailored to your specific situation.

“It’s a great idea when you’re struggling with debt to get free debt advice from a charity or a debt non-for-profit,” notes Businessing Magazine. These organizations can help you work out your debts and create a manageable budget.

3. Creditor Negotiation

Professional debt relief services negotiate directly with your creditors, potentially reducing interest rates, waiving fees, or even lowering principal balances.

This negotiation process can save you significant money and stress compared to trying to negotiate on your own.

Choosing a Trustworthy Service

The Federal Trade Commission recently announced a permanent ban on a fraudulent debt relief operation, highlighting the importance of selecting legitimate services.

Search for companies with transparent fee structures, clear explanations of their process, and no upfront fees before services are delivered.

Check reviews, ratings with the Better Business Bureau, and ask about their success rates with clients in situations similar to yours.

Cero Deuda: Support for Hispanic Americans

For Spanish-speaking Americans, Cero Deuda offers specialized debt relief services that understand cultural nuances and language preferences.

Their three-step process includes financial analysis, creditor negotiation, and creating personalized payment plans that typically span 12-48 months.

What sets them apart is their cultural understanding and bilingual support, making the debt relief process more accessible and comfortable for Hispanic communities.

Taking the First Step

The journey to financial freedom starts with a single step: acknowledging your situation and seeking help. Get in touch debt experts contact number for a free consultation to understand your options.

Remember that finding relief from debt is a process, not an overnight solution. With patience and the right support, you can gradually reduce your financial burden and the stress that comes with it.

The path to financial wellness is available to everyone – you just need to take that first step.

Read More: one piece filler

-

Biography7 years ago

Biography7 years agoJacqulyn Elizabeth Hanley is the Mother of Liza Soberano?

-

Home6 years ago

Home6 years agoEpson L3110 Driver Free Download Latest Updated Version

-

Biography7 years ago

Biography7 years agoAmanda Levy Mckeehan Biography, Family, Net Worth, Age, Affairs, Facts

-

Games4 years ago

Games4 years agoBest Free To Play MMORPG To Try This 2021

-

Biography7 years ago

Biography7 years agoWho is Rose Dorothy Dauriac? Scarlett Johansson Daughter?

-

Biography6 years ago

Biography6 years agoJessica Ditzel Secret Information that Nobody Knows | Joe Rogan’s Wife

-

Home7 years ago

Home7 years agoLiza Soberano Biography, Age, Family and Boyfriends

-

Biography7 years ago

Biography7 years agoWhat is the relation of Nathaniel Larry Osorno with Liza Soberano?